Listen to the audio episode: (11:05)

1x

0:00

11:05

Get The Complete Price Action Strategy Checklist!

Several months ago, I stopped using my favorite charting platform – Meta Trader 4 at the time – to do all my technical analysis on TradingView. After being asked on several occasions, I thoughtit was time for me to come up with a TradingView review and to discuss the things I like and don't like about the online charting platform.

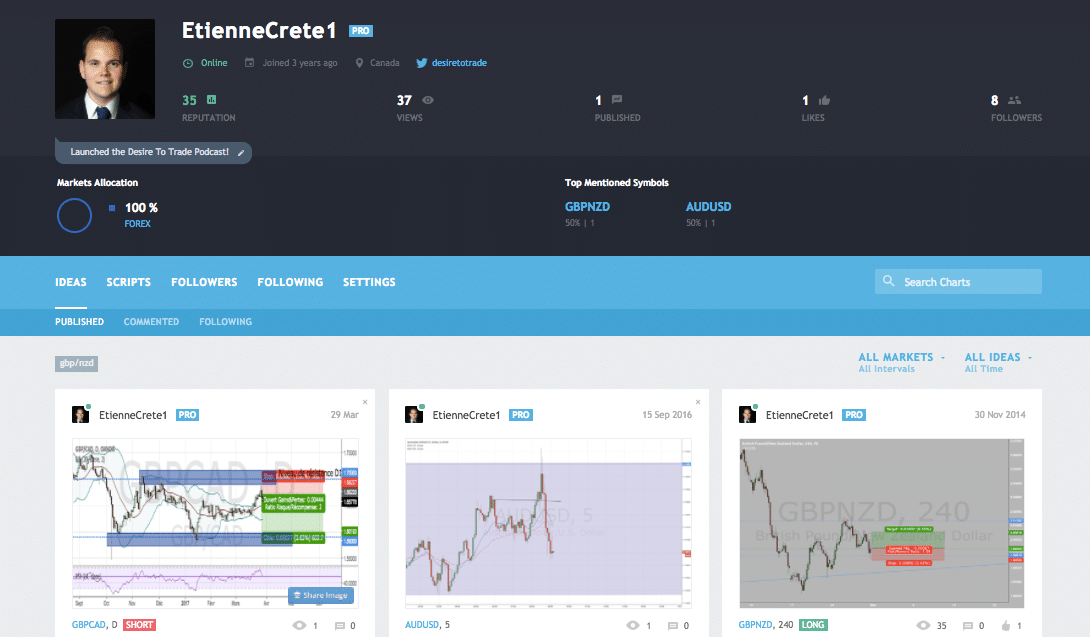

To start with, I just want to ensure I eliminate the confusion about what TradingView is and isn't. In short, it's an online portal with charts…but it doesn't stop there. TradingView is an entire social/trader's network where anyone can publish a trade idea.

For some notable people to follow(if you have any recommendations, let me know!):

- Akil Stokes –https://www.tradingview.com/u/Akil_Stokes/

- Jason Graystone –https://www.tradingview.com/u/J_Graystone/

- Etienne Crete (yeah, that's me) –https://www.tradingview.com/u/EtienneCrete1/

The first thing I must point out is that TradingView is accessible pretty much anywhere (by that I mean it isn't blocked in China, and you can access it even from a mobile device). I've had no problem with it in Indonesia, where Forex brokers such as Oanda are typically blocked.

1. Ability To Draw Anything On Any Chart

I'm a really visual person, and Ifelt kind of limited by the idea that I could only draw horizontal/vertical lines in Meta Trader 4.

I know there are a couple of different shapes and other tools in Meta Trader, but TradingView is way ahead.

Whenever I want to explain something to someone or draw for my own reference (where I think the price will go), I take the pen inside TradingView to draw freely.

Not only that but literally all the trading tools you could ever think of placing on your chart are there. Not that I'm a fan of complicating things, but I know people who have complicated trading styles.

Although it can be challenging to draw with a computer mouse, you end up getting used to it, and that allows you not to forget anything anymore.

WatchBar Replay To Backtest On TradingView!

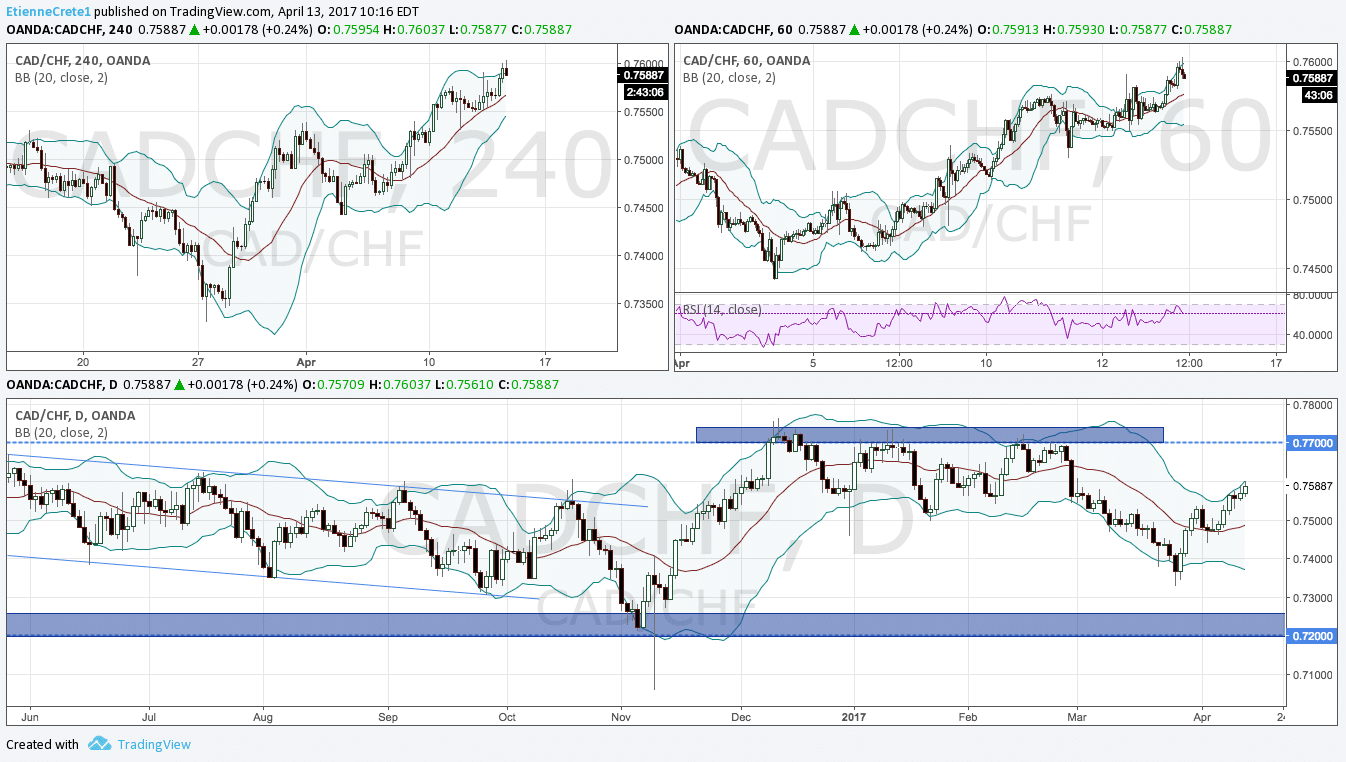

2. Ability To Split Your Screen Into Many Synced Up Charts

Depending on your trading style, you might need to look at multiple time frames prior to entering a trade.

That can be a real pain! Often you need to click a button and switch back and forth between the time frames. Or, you can open up multiple charts in advance, in which case your drawings/indicators will only appear on one chart.

TradingView makes looking at the timeframes much easier by allowing you to see multiple charts on the same screen.

What's even better is that your drawings can be synced up on all charts if you choose to.

Then, whenever you look at various currency pairs from your watchlist, you can lock the timeframes you selected so that they remain the same whatever you look at.

That's probably my favorite thing in TradingView! But there's one more thing I want to mention…

3. Accountability By Publishing Your Trade Ideas

Accountability is precious. I've personally seen traders significantly improved when they started sharing what they were doing with other traders.

Some experienced traders even go as far as sharing their stats every month with their wife or husband. That way they feel accountable to someone, and it pushed them to work harder.

What's great is that, in the case you don't have anyone to keep you accountable, the online world becomes an amazing resource.

TradingView has a social function through which you can publish trade ideas. Those ideas are images of potential trades based on your analysis. Publishing those trade ideas forces you to make sure that you respect the analysis part of your plan.

And the fact that TradingView is such a big platform makes it very likely that people will interact with your trade ideas, perhaps creating an opportunity for you to learn from other traders as well.

Watch:Quick Trading Tip: TradingView with Oanda

1. You Have To Pay For Some Basics Features

As TradingView offers some amazing features, a fraction of them is reserved for paid members. For instance, a screen with multiple charts will require you to purchase a Pro subscription.

For me, that's not much of a problem because I expect I'll need to pay if I want a very solid tool. However, it has to be mentioned as one of the reasons new traders may abstain from using TradingView.

2. You'll Need To Have 2 Platforms At All Times

TradingView by itself isn't a trading platform through which you can place trades. While it is true that TradingView associated with some brokers like Oanda and FXCM, in most cases you won't be able to enter your trades from the charting platform itself.

That means you'll be required (pretty much all the time) to use your broker's platform in addition to TradingView. It can be a bit confusing at first, especially when you're used to doing everything on one platform.

UPDATE: TradingView significantly made it easier to sync your Oanda account. Watch How To Place Trades On TradingView for more info.

3. Charts Don't Always Sync Up

One of the troubles I have seen on TradingView is that you never really know whether the drawings you made on your chart got saved. Sometimes, closing your browser too fast makes you lose all your recent analysis work.

Right now, TradingView offers 4 plans with different advantages. Although I am aware that these plans might change, here's a quick breakdown of what they include at the moment:

- Free: good for one chart at a time with indicators.

- Pro: great option to start and add a few more features to your experience (at $9.95/month)

- Pro Plus: pretty much all the features a trader could need and it's unlimited (that's the plan I'm on)

- Premium: includes a couple of fancy features such as SMS alerts

For me, I think it became a must. When I travel, there's no way I'll run Meta Trader 4 on my Mac as it consumes way too much battery. Having a website I can easily access makes it easier to load a chart quickly and close it whenever I want. I can draw anything and share it with “anyone” (I include my trading journal in ‘anyone').

However, if you're always trading at home or on a PC, TradingView might not mean the same thing. It's up to you to see whether you'll truly benefit from it – although I doubt you wouldn't.

I hope this TradingView review has helped you understand what that tool was all about. I could go on and on talking about the things I like about the platform, but there are also other things not to like. That's why I need your help!

Are you an active user of TradingView? What do you like/dislike about it? Comment below and we can chat!

Disclosure: I am not paid by TradingView to write this post. I just love the tool 🙂 This post may contain affiliate links. I may receive a small commission if you choose to purchase something from a link we post. Don’t worry, it won’t cost you anything. This small percentage just helps me produce more content and shows me you care about what I do. I'll always appreciate your support!